Report highlights cold storage squeeze

A new report has found Australia is facing a critical shortage of cold storage infrastructure, especially along the eastern seaboard.

Keeping it Cool – The Rise of Cold Storage is a report compiled by Savills Australia and SA1 Property. According to the report, vacancy rates for refrigerated warehouses are alarmingly low, with institutional investors and private equity firms aware of the sector’s potential and need for growth.

Savills says the situation highlights the potential for investors in the sector.

“Cold storage is no longer a niche play,” says Michael Wall, National Head of Industrial and Logistics at Savills Australia and New Zealand. “It is core to the future of supply chains, food security, and pharmaceutical distribution, and its strategic value is on the rise. For investors and developers, the signals are clear – demand is real and supply is low.”

Rising demand

Savills says demand for cold storage is being fuelled by population growth, the expansion of pharmaceutical supply chains, and dominant e-commerce trends. Household incomes are also rising thanks to moderating inflation and wage growth, shifting preferences toward fresher, more convenient food while increasing restaurant and hospitality spending – further amplifying demand.

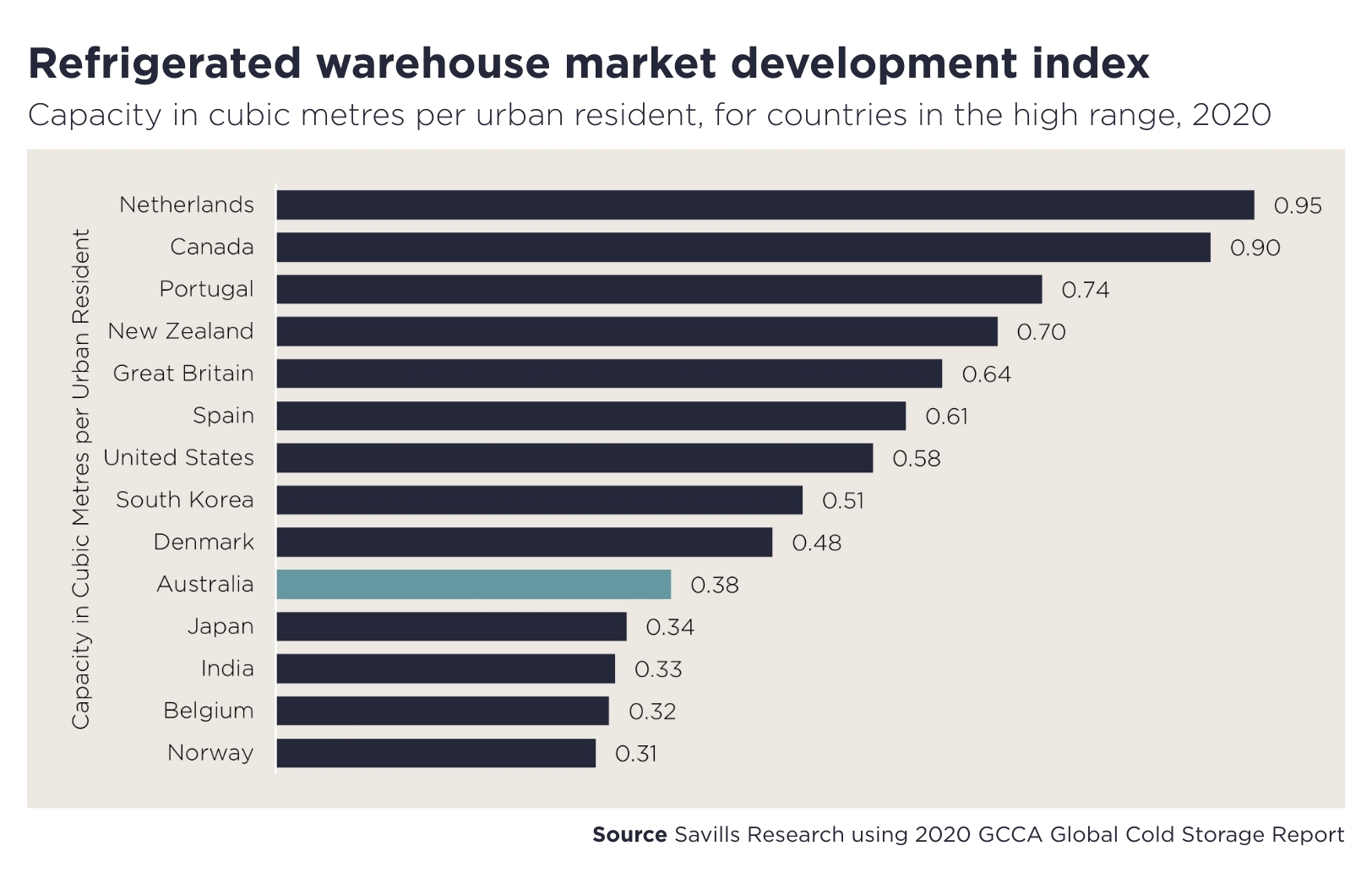

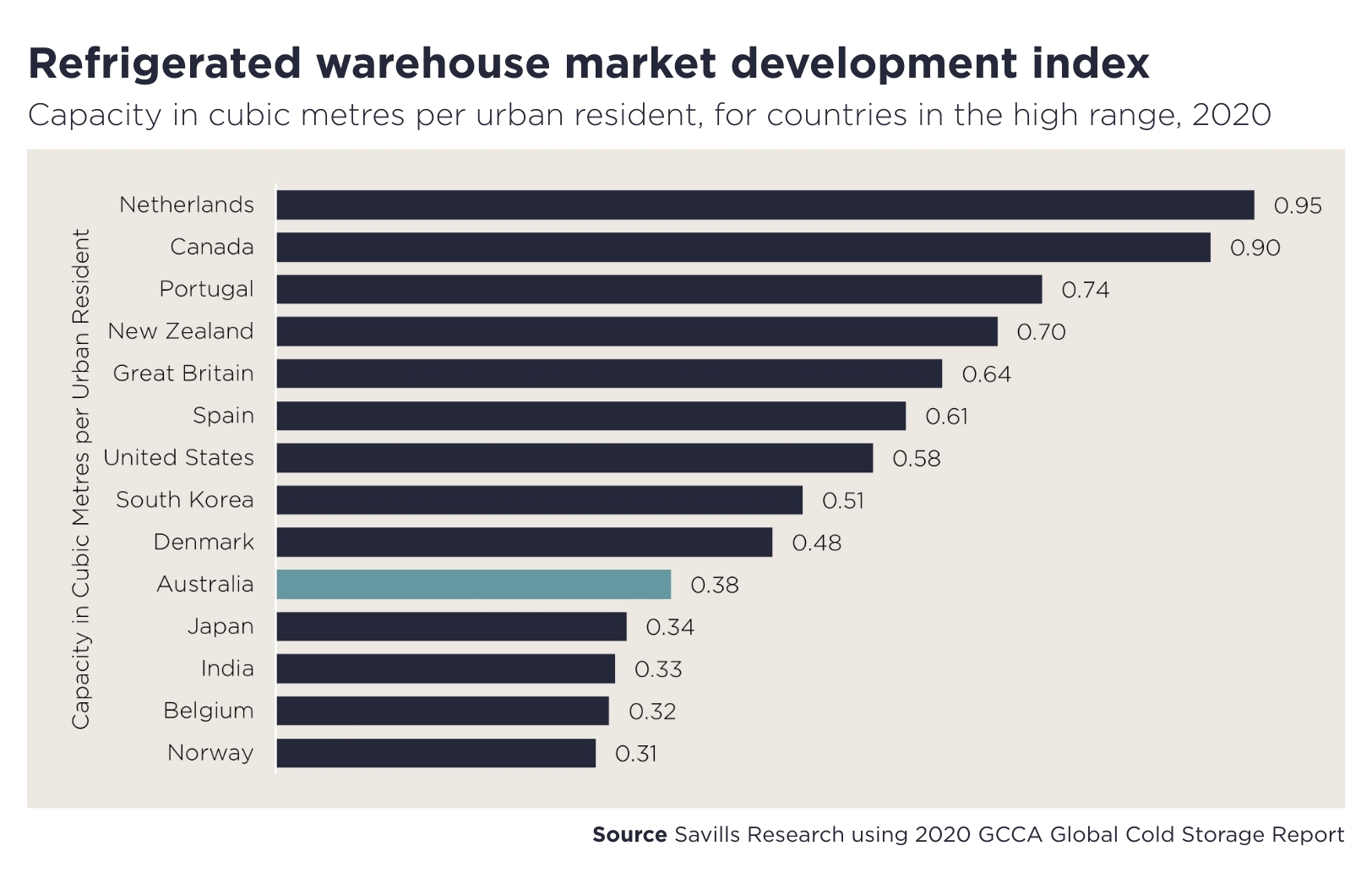

Despite significant population growth since 2020 and an urbanisation rate of nearly 91%, Australia’s volume of cold storage stock has remained relatively unchanged; the report identifies “virtually non-existent” vacancy across the eastern seaboard, particularly in Melbourne, Sydney and Brisbane.

“With the exception of Sydney’s Central West, most infill locations – from Melbourne’s inner north to Brisbane’s trade coast – are facing a clear shortfall in cold storage supply,” says Katy Dean, Head of Research at Savills Australia and New Zealand.

By the numbers

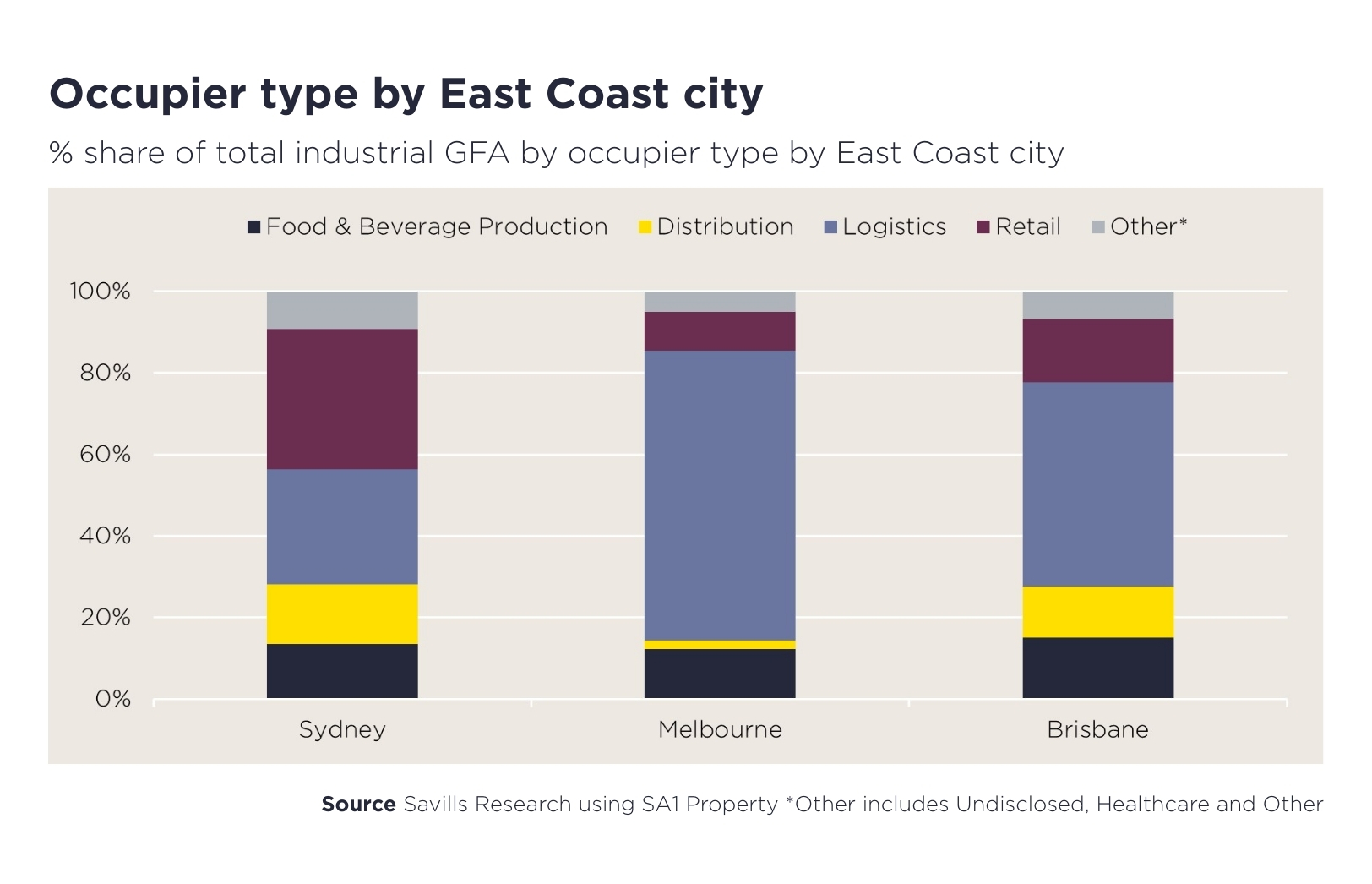

According to the report, logistics dominates occupancy at 50%, followed by food and beverage (15%), retail (15%), and distribution (12%).

Melbourne has the largest cold storage footprint on the east coast at over 1.16 million square metres, occupying 1.58% of its total industrial gross floor area (GFA). Around 60% of the city’s cold storage is located in its western suburbs. Logistics operators comprise 71% Melbourne’s cold storage occupiers – the highest share of any market.

Sydney presents the most balanced cold storage profile, but the sector accounts for just 0.75% of the city’s total industrial GFA. Take-up is led by retail (34%), logistics (28%), distribution (15%), and food and beverage production (13%). Due to high costs and land constraints, occupiers tend to be large-scale food distributors, grocery chains and last-mile logistics providers.

Institutional ownership

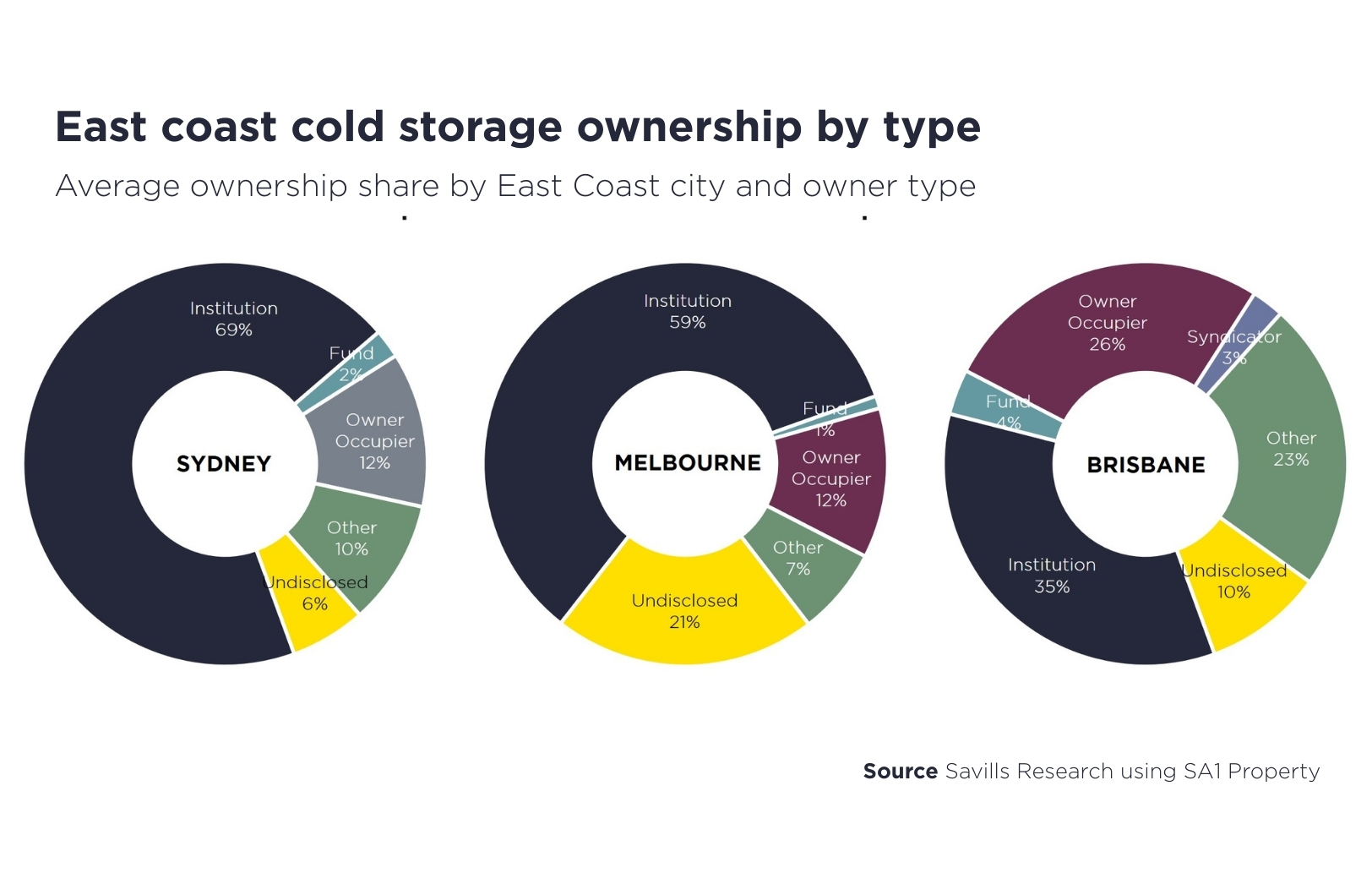

The report also highlights just how much of the nation’s cold storage infrastructure is owned by institutions.

According to the report, Sydney’s cold storage sector has the highest share of institutional ownership at 69% of facilities. In Melbourne, that figure is 59%, while Brisbane is a much less consolidated market, with an institutional ownership rate of 35%.

“Australia’s cold storage market presents a clear opportunity for developers and investors to meet rising demand, particularly in urban areas where infrastructure is scarce,” Dean says.

“Surging demand and limited modern supply position cold storage as a sector offering a long-term competitive advantage, especially in under-institutionalised, high-growth submarkets.”

Quality of facilities

While the report notes that a high percentage of Australia’s cold storage is older stock, which remain vital to the supply chain, it also highlights the strengths of newer assets.

The report identifies building height as a metric for asset quality, noting that lower-height stock often indicates older facilities. Sydney has the tallest facilities at an average 10.9m high, while Melbourne and Brisbane average closer to 10.1m. The report notes that higher clearances enable greater pallet density, better air circulation, and easier integration with automation, which is particularly important in markets like Sydney where land prices can be prohibitive.

Despite this, the report highlights the cost effectiveness of retrofitting old facilities rather than building new ones.

“Incremental upgrades like higher-performance insulation and refrigeration offer a relatively low-risk, high-impact way to reposition older cold storage stock,” Wall says. “In infill locations where land is scarce, even modest retrofits can outperform greenfield alternatives,” Wall says.

Read the report

You can read the full report for free via the Savills website.

PREV

NEXT

Comments

Advertisements

Recent news

- February–March issue of HVAC&R News out now

- Reliable Controls marks 40-year milestone

- Conex Banninger and Reese launch enhanced fitting range

Latest events

- The path ahead for the VEU – industry webinars

- Additional keynote announced for HVAC26

- PSO to host focus groups at AIRAH Hobart Industry Night

Nick Johns-Wickberg

Nick Johns-Wickberg

Leave a Reply