Australia’s cold storage vacancy hits 0.6%

New modelling shows pressures as obsolescence and rising demand widen the supply gap.

Australia’s cold storage sector is under increasing strain, with vacancy rates falling to just 0.6% – well below the national logistics and industrial average of 3.0%. New research by Cushman & Wakefield reveals a shortfall of approximately 130,000m2 of space, with further pressure anticipated as ageing facilities fail to meet current tenant standards.

According to the Frozen Logistics report, the country’s cold storage footprint stands at 3.1 million m2. However, roughly 15% of these facilities are no longer fit for purpose, and this figure could rise to 25% by the early 2030s due to evolving tenant requirements, including automation, sustainability, and flexible operations.

The statistics

The report combines a national stock assessment with direct insights from major occupiers and forecasts that an additional 950,000m2 of space will be needed over the next decade, driven by an expected population growth of 3.8 million people.

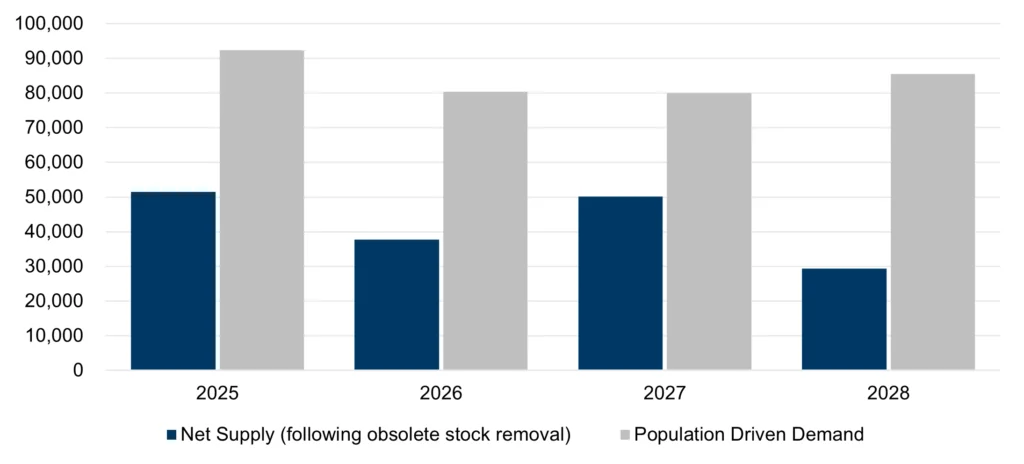

Cold storage supply vs demand (m2)

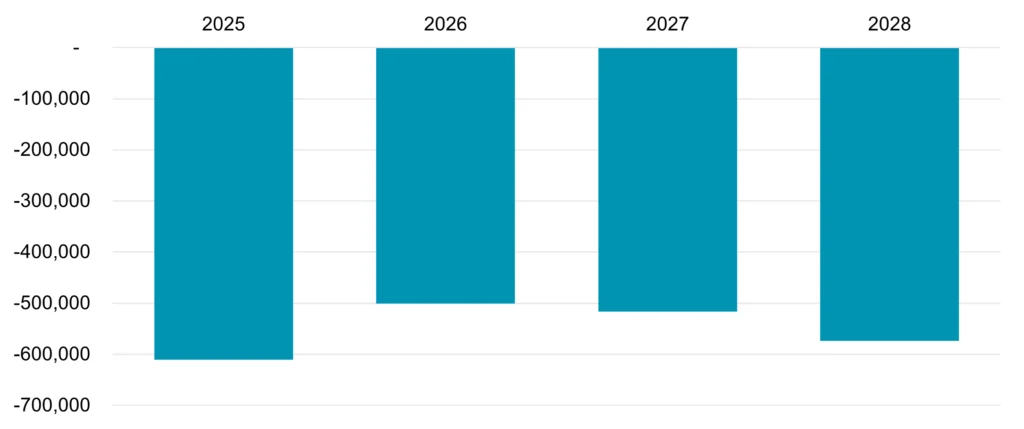

Cold storage stock shortfall (m2)

Includes obsolete stock

Luke Crawford, Head of Logistics and Industrial Research, Australia at Cushman & Wakefield, says the strength of demand is changing development patterns across the cold storage sector.

“Cold storage has undergone significant growth over the past decade,” Crawford says.

“Online food delivery, pharmaceuticals and industry consolidation are driving demand, and it’s reshaping how the sector looks at development.”

Luke Crawford, Head of Logistics and Industrial Research, Australia at Cushman & Wakefield

“We’re seeing speculative projects receive strong interest from occupiers, particularly for freezer space, as there is next to no vacancy for this type of product nationally

“Traditionally, cold storage has been a contract-led sector, with occupiers locking in long-term deals before facilities are even built. But due to demand, developers … are more confident building without a tenant in place and it’s paying off.”

The total market value is estimated at $12–14 billion, with rents rising by around 70% in the past five years. Despite strong fundamentals, institutional investment remains limited due to the complexities of temperature control and regulatory compliance. However, investor interest is expected to grow in the near term, particularly through asset acquisition and build-to-core strategies.

Addressing obsolescence

Obsolescence poses a significant challenge, particularly for facilities unable to support modern operational requirements. Location remains the most important factor for occupiers, prompting consideration of retrofitting existing ambient warehouses.

David Hall, National Director, Head of Brokerage ANZ at Cushman & Wakefield, says retrofits could provide a pathway to easing the supply shortage.

“We know approvals and lead times for new, build-to-suit facilities are too long for many occupiers. That’s where retrofitting existing ambient warehouse stock to cold storage can provide a solution to better meet occupier needs,” he said.

“It’s not straightforward given the structural, mechanical and operational considerations, but for well-located sites, the potential upside is significant. We’re already seeing a few early movers test this approach, and we expect it to pick up pace over the next five years.

“Every retrofit is different and there is no one-size-fits-all solution, but in the right context it can help owners and occupiers unlock value and a faster path to market.”

PREV

NEXT

Comments

Advertisements

Recent news

- February–March issue of HVAC&R News out now

- Reliable Controls marks 40-year milestone

- Conex Banninger and Reese launch enhanced fitting range

Latest events

- The path ahead for the VEU – industry webinars

- Additional keynote announced for HVAC26

- PSO to host focus groups at AIRAH Hobart Industry Night

Laurence Acosta

Laurence Acosta

Leave a Reply